The Difference Between Straight and Order Bills of Lading

As a document of title and proof of the transportation contract, the type of ocean bill of lading (OBL) directly impacts your control over your goods and the security of your funds. Straight and order bills of lading are the two most frequently asked questions and often the most confusing.

Table of Contents

This article, from the perspective of an international logistics service provider, will provide an in-depth analysis of the core differences between the two and offer practical advice to help you seize the initiative in cross-border trade.

Core Functions of a Bill of Lading

Contract of Carriage: This is a legally binding agreement between the shipper and the carrier outlining the terms and conditions of transportation.

Goods Receipt: Confirms that the carrier has received the goods intact. Document of Title: This is the key difference between a straight bill of lading and an order bill of lading. It specifies who is entitled to claim the goods at the destination.

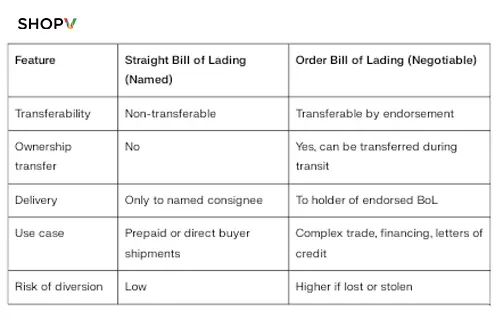

Core Definitions of Straight and Order Bills of Lading

A straight bill of lading (Named Bill of Lading)

Definition

The consignee field on the bill of lading specifies the name of a specific company or individual (e.g., "To ABC Company"), restricting the delivery of the goods to the named consignee. This is also known as a non-negotiable bill of lading.

Legal Attributes

A non-negotiable bill of lading does not serve as a document of title. The carrier must deliver the goods to the consignee named on the bill of lading, and even third parties in possession of the bill of lading are not entitled to claim the goods. This bill of lading cannot be transferred by endorsement. The shipping company will only deliver the goods to this named consignee, who can claim the goods upon proof of their identity, without the need to present the original bill of lading (this is the practice in most countries, such as the United States, for shipping).

Ownership of Title

Ownership of the goods directly vests in the specific consignee named on the bill of lading. Advantages

Simple process, quick delivery, and avoidance of port detention fees (demurrage) due to delays in the original bill of lading.

Risks

The shipper loses control of the goods. Once the goods are loaded, if the consignee refuses to pay, it is difficult for the shipper to prevent the consignee from delivering the goods by withholding the bill of lading. Payment recovery relies on commercial credit rather than property rights.

Typical Scenarios

Exhibits and valuables shipped over short distances (such as Southeast Asia routes).

High trust between buyers and sellers, eliminating the need for bank settlement (such as parent-subsidiary transfers).

Sample shipments with low value and manageable risks.

Why use a straight bill of lading?

It ensures that goods are delivered only to the designated consignee, reducing fraud or misdelivery.

Delays are reduced because no endorsement or transfer documents are required.

Suitable for prepaid shipments or shipments where the seller and buyer have clear and direct agreements.

Reducing the risks and complexities associated with the transfer of title during transportation.

Order Bill of Lading

Definition

The consignee column is filled in with "To Order" or "To Order of [Bank/Shipper]." Endorsement is required to transfer title to the goods. This is also called a negotiable bill of lading.

Legal Attributes

A negotiable bill of lading is the most commonly used document of title in international trade. The holder can transfer the bill of lading to a third party (such as the buyer, bank, or new purchaser) by endorsement.

Ownership of Property

Ownership of the goods belongs to the holder of the bill of lading. This bill of lading can be transferred through endorsement. The original shipper can transfer title to another party (such as a bank or new purchaser) by signing and stamping the reverse of the bill of lading.

Advantages

Gives the shipper significant control over the goods. Under the letter of credit payment model, the shipper submits the endorsed bill of lading to the bank. The consignee can redeem the bill from the bank and collect the goods from the shipping company with the original bill of lading only after paying the full amount. This provides a solid guarantee of payment upon shipment.

Risks

The process is relatively complex and strictly relies on the circulation of the original bill of lading. Delays at any stage (such as mail delays or slow bank processing) can result in delays in timely pickup of goods upon arrival at the port, resulting in high demurrage and port charges.

Typical Scenarios

Commodity transactions settled by letter of credit (L/C).

Trade requiring financing (such as through bank bill advance).

Long-term B2B clients who require flexible adjustments to the consignee.

FAQs

How does the endorsement process for an order bill of lading work?

Blank endorsement: The shipper signs the back of the bill of lading (without specifying a transferee), making the bill of lading a "holder bill of lading" with the highest liquidity. Whoever holds the original bill of lading owns the title.

Signature endorsement: The shipper specifies the transferee's name (e.g., "To XYZ Bank"), limiting pickup to the designated party.

Notes:

Endorsements must be continuous (e.g., seller → bank → buyer); otherwise, the carrier may refuse to release the goods. Telex Release (Telex Release) does not require the original bill of lading, but does require a letter of guarantee from the shipper, which carries a higher risk.

Telex Release (Telex Release) is a popular practice, but what type of bill of lading is it?

Telex Release is a method of operation, not a type of bill of lading. It can be applied for with either a named or order bill of lading. Essentially, a telex release involves the shipper requesting the shipping company to release the goods to the designated consignee without the original bill of lading. This is very effective in preventing loss of the original bill of lading or mailing delays. However, applying for a telex release automatically waives your right to control the goods with the original bill of lading. Please ensure you receive full payment before proceeding.

Can Middle Eastern and South American countries really release goods without the original named bill of lading?

Yes. Port laws in many countries, including Saudi Arabia, the UAE, Brazil, and Venezuela, allow for the "named bill of lading + consignee identification" method of delivery. Solutions:

Prepayment of at least 30%;

Purchase export credit insurance;

Use an order B/L and control endorsements.

How can Shopv help you solve your bill of lading challenges?

Shopv is committed to providing efficient, secure, and compliant international logistics solutions for B2B businesses and e-commerce sellers. Whether you're exporting for the first time or need to navigate the complexities of bill of lading endorsement and cargo title transfer, Shopv can tailor a service plan for you.

In the "bill of lading war" of international logistics, choosing between a named bill of lading and an order bill of lading is essentially a game of risk versus efficiency. A bill of lading is not only a document of cargo; it's also the lifeline of a company's funds and cargo rights. With Shopv's professional services, you'll easily navigate the differences between named and order bills of lading, ensuring transaction security and accelerating capital turnover. Act now and embark on a worry-free logistics journey!